When a King Bows Out–Planning for the Inevitability of Death

Legacy and Succession Planning in Nigeria

Why is Succession Planning Important

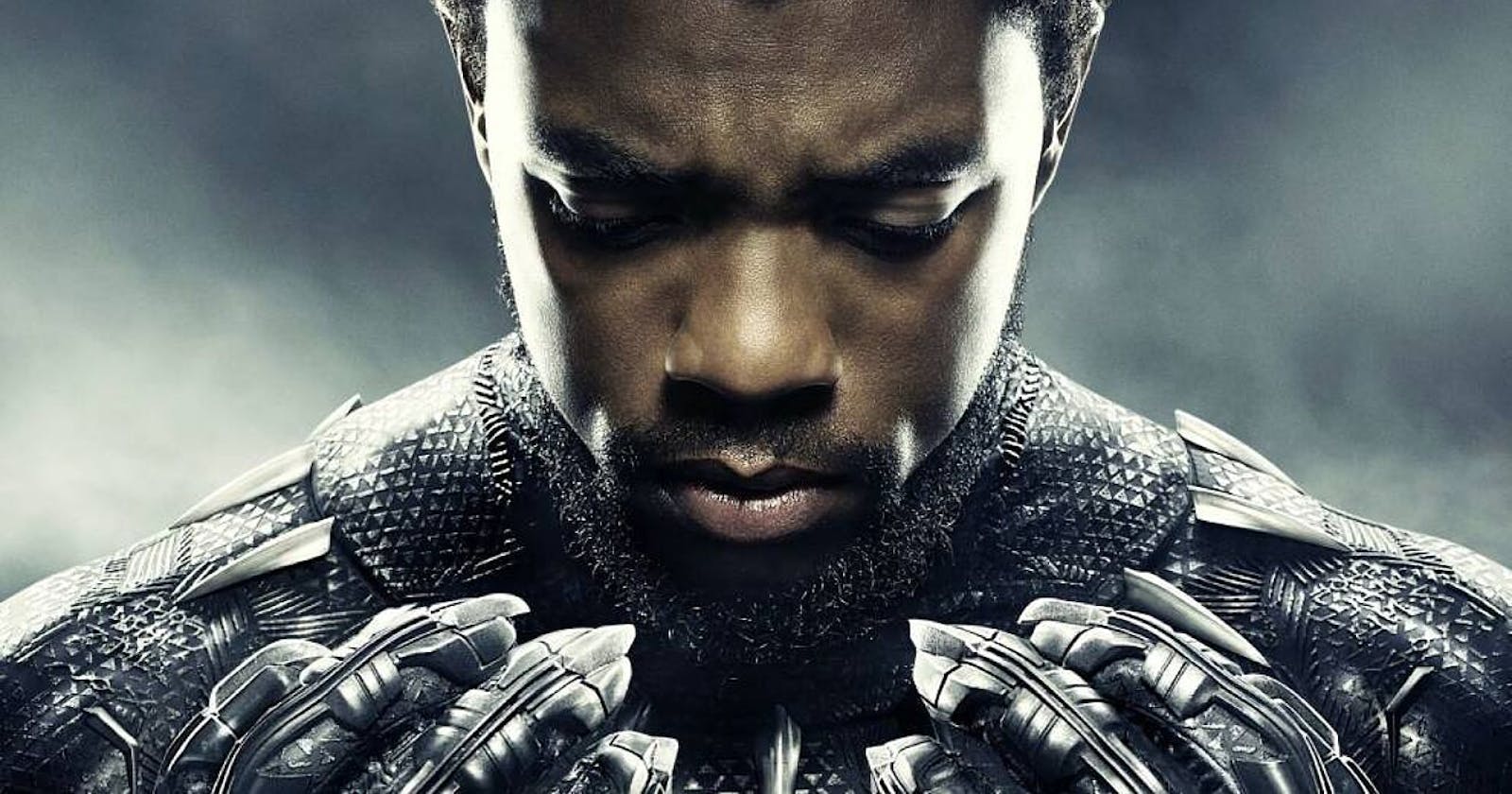

Chadwick Boseman, who played the role of the Black Panther–King T'challa–is one of Marvel’s most iconic characters and, I dare say, the most charismatic King in the Marvel universe.

He embodied the role and got the entire world crossing arms to say “Wakanda forever”. Unfortunately, his promising career was cut short by colon cancer in 2020 and this left the whole world in shock.

Recently, it was reported that Chadwick Boseman's estate lost over $900,000 to legal and other fees due to the dispute over his inheritance. This happened because Chadwick Boseman died without leaving a Will–essentially, dying intestate.

As a result of dying intestate, his wife and parents went to court to contend for entitlement to his estate which was originally worth about $3.8 million. Parties settled amicably and the sum of $2.3 million that was left after legal and other fees, including inheritance taxes, was shared equally between his wife and his parents.

The news of Chadwick Boseman’s estate’s losses brings to the fore the need for individuals to have proper estate planning while alive.

People like to avoid thinking of death, but it is inevitable and we all should take responsibility for ensuring that those who depend on us have something left for them when we’re gone. In taking these steps it is also important to consider the cost and time implications of each estate planning method.

Here are 7 ways of planning wealth transfer that would benefit your estate more than the government (taxes):

1. Will.

A will ensures that your assets are distributed in line with your wishes. This is the most common option, but the process of obtaining probate is expensive and takes a lot of time, especially if you’re trying to obtain probate in Lagos, Nigeria. In addition to legal fees, this option also subjects the assets to estate taxes of 10% of the value of the estate. So it is important to combine this option with other options.

2. Trust.

A trust is a fiduciary relationship in which one party, known as a grantor/settlor, gives another party, known as the trustee, the right to hold title to property or assets for the benefit of a third party, the beneficiary.

Trusts are either created during the lifetime of the grantor (which is called inter vivos trust or living trust) or by Will, otherwise known as a testamentary trust. It is advisable to create a trust during your lifetime because, (depending on the terms of the trust), you can keep amending it till you die.

There are several advantages of trust over a Will. Here are a few advantages of trust:

Setting up a trust is a faster and easier way of transferring property. With trusts, the beneficiaries have access to the assets immediately after the deceased dies as compared to Wills where probate must be obtained from the court. The process of obtaining probate from the court takes time and money. A trust minimises or eliminates estate taxes.

Property is protected in the case of divorce

- Offshore trusts protect wealth from depreciation.

- Trust can be revocable or irrevocable. In a revocable trust, the settlor's business and personal affairs are managed during his or her lifetime, and he or she can revoke or make adjustments in the trust as and when necessary. It ensures the certainty and peace of mind of the settlor.

- A trust protects the privacy of the settlor, while a Will is usually accessible to the public.

- A living trust allows for continuous investment and easy oversight. Since the settlor is still alive, he or she can easily monitor the trustee's activities to make sure his or her intentions regarding the trusts are carried out.

3. Give your assets away during your lifetime.

This could be by reducing your holdings in your companies etc and giving away those shares, lands and houses that you want to give away.

4. Life insurance.

Proceeds from life insurance policies payable to a named beneficiary pass tax-free to that beneficiary.

5. Family office.

A family office is a privately held company that handles investment management and wealth management for a wealthy family, it hires staff (usually lawyers and accountants) whose job is to invest and protect the family's wealth, manage assets and assist the family's lifestyle with the goal being to effectively grow and transfer wealth across generations. It holds all your investments and properties in one place so that you can see them all at a glance. Creating a family office is another viable option for succession planning. Before opting for this estate plan, an individual must consider numerous factors, such as his or her wealth, the complexity of his or her life, and the priorities of his or her family.'

6. Joint accounts or co-signatories.

This way when the deceased dies, the spouse/child has immediate access to funds needed for the funeral and other immediate costs/needs.

7. Joint tenancies or tenancies in common.

This is a situation where two individuals hold interest in one land and the share of each passing to the other or others on death. This avoids the need for a Will.

How Professionals can help

A law firm that specialises in private client/wealth management can assist individuals in developing tax-efficient succession plans that are suitable for their wealth transfer strategies. Ultimately, you must sit down with your lawyers and financial advisors to determine which of the foregoing options is best suited to your needs..